# Is MyPrepaidCenter Legit? Your Ultimate Guide to Safe Prepaid Rewards (2024)

Navigating the world of online rewards and prepaid cards can be tricky. You’ve likely stumbled upon MyPrepaidCenter, a platform offering prepaid cards as rewards for various promotions, surveys, or loyalty programs. But the burning question remains: **is MyPrepaidCenter legit?** This comprehensive guide aims to provide you with a definitive answer, going beyond surface-level reviews to deliver an expert, in-depth analysis of the platform’s legitimacy, security, and overall user experience. We’ll explore every facet of MyPrepaidCenter, equipping you with the knowledge to confidently determine if it’s a safe and worthwhile option for managing your prepaid rewards. This guide will cover the ins and outs, common issues, and what to look out for when engaging with MyPrepaidCenter, ensuring you make an informed decision.

## Deep Dive into MyPrepaidCenter: Understanding the Platform

MyPrepaidCenter serves as a third-party platform that facilitates the distribution and management of prepaid cards, often branded with Visa or Mastercard. Unlike traditional gift cards tied to a specific retailer, these prepaid cards function more like debit cards, allowing you to spend the funds at virtually any merchant that accepts Visa or Mastercard. However, this flexibility also raises concerns about security and legitimacy. Understanding the scope and nuances of MyPrepaidCenter is crucial before entrusting it with your financial information.

### Core Concepts and Underlying Principles

At its core, MyPrepaidCenter acts as an intermediary between businesses offering rewards and consumers receiving them. Companies partner with MyPrepaidCenter to streamline the process of distributing prepaid cards, eliminating the need to handle physical cards or manage individual payments. This system relies on secure online portals and digital card management, offering convenience for both businesses and consumers. The process typically involves receiving a virtual card or a physical card through the mail, activating it on the MyPrepaidCenter website, and then using it for online or in-store purchases.

### Importance and Current Relevance

In today’s digital landscape, prepaid cards have become increasingly popular as incentives, rewards, and payment solutions. MyPrepaidCenter taps into this trend by providing a centralized platform for managing these cards. Its relevance lies in its ability to simplify the process of receiving and using prepaid rewards, offering a convenient alternative to traditional checks or gift cards. The platform’s efficiency and accessibility make it a valuable tool for businesses looking to incentivize customers and employees alike. Recent trends indicate a growing reliance on digital payment solutions, further solidifying MyPrepaidCenter’s position in the market.

## Mastercard Prepaid Cards: A Closer Look

MyPrepaidCenter primarily deals with Mastercard prepaid cards (and sometimes Visa). These cards function similarly to regular debit cards, allowing users to make purchases online, in stores, or even withdraw cash from ATMs (though ATM withdrawals may incur fees). The key difference lies in the funding source: instead of drawing from a bank account, the card is pre-loaded with a specific amount of money, making it a safer option for managing spending and avoiding debt. Mastercard, as a global payment network, provides the infrastructure and security protocols that underpin these prepaid cards, ensuring widespread acceptance and reliability.

### Expert Explanation of Mastercard Prepaid Cards

From an expert standpoint, Mastercard prepaid cards offer a versatile and secure payment solution. They provide a level of financial flexibility without requiring a bank account, making them accessible to a broader range of users. The cards are typically reloadable, allowing users to add funds as needed, and often come with features like online account management and transaction tracking. Mastercard’s robust security measures, including fraud monitoring and zero-liability protection, further enhance the appeal of these prepaid cards. What sets them apart is the universal acceptance and the added layer of security compared to carrying cash.

## Detailed Features Analysis of MyPrepaidCenter

MyPrepaidCenter offers a range of features designed to streamline the management and use of prepaid cards. Let’s delve into the key features and their benefits:

1. **Online Account Management:**

* **What it is:** A user-friendly web portal where cardholders can access their account information, check their balance, view transaction history, and manage card settings.

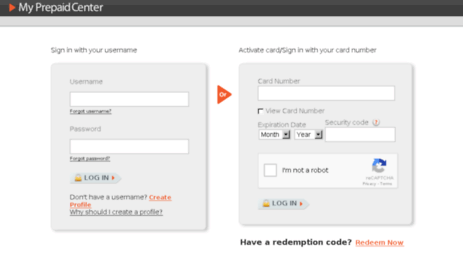

* **How it works:** Users create an account on the MyPrepaidCenter website, link their prepaid card, and gain access to a personalized dashboard.

* **User Benefit:** Provides convenient 24/7 access to card information, enabling users to track spending, monitor their balance, and stay informed about their card activity. This feature demonstrates quality by providing real-time insights and control over their prepaid funds.

2. **Card Activation:**

* **What it is:** The process of activating a newly received prepaid card, typically requiring the card number, expiration date, and security code.

* **How it works:** Users enter the required information on the MyPrepaidCenter website, and the system verifies the card details and activates it for use.

* **User Benefit:** Enables immediate access to the funds on the prepaid card, allowing users to start making purchases or withdrawing cash. The activation process is straightforward and secure, ensuring a seamless user experience.

3. **Transaction History:**

* **What it is:** A detailed record of all transactions made with the prepaid card, including the date, time, merchant, and amount of each transaction.

* **How it works:** The system automatically records all card transactions and displays them in a chronological order on the user’s account dashboard.

* **User Benefit:** Provides a clear and comprehensive overview of card spending, helping users track their expenses, identify potential errors, and manage their budget effectively. This transparency fosters trust and accountability.

4. **Balance Inquiry:**

* **What it is:** The ability to check the current balance remaining on the prepaid card.

* **How it works:** Users can check their balance online through their account dashboard or by calling a dedicated customer service line.

* **User Benefit:** Enables users to stay informed about their available funds, preventing declined transactions and ensuring they have sufficient funds for their intended purchases. Real-time balance updates enhance the user experience and prevent frustration.

5. **Security Features:**

* **What it is:** A range of security measures designed to protect cardholders from fraud and unauthorized access, including encryption, fraud monitoring, and zero-liability protection.

* **How it works:** The system employs advanced encryption techniques to safeguard card data and monitors transactions for suspicious activity. Cardholders are typically not liable for unauthorized transactions reported promptly.

* **User Benefit:** Provides peace of mind knowing that their prepaid card is protected from fraud and unauthorized use. These security measures build trust and confidence in the platform.

6. **Customer Support:**

* **What it is:** Access to customer service representatives who can assist with card-related inquiries, resolve issues, and provide technical support.

* **How it works:** Users can contact customer support via phone, email, or online chat.

* **User Benefit:** Provides a reliable resource for resolving any problems or concerns related to their prepaid card. Responsive and helpful customer support enhances the user experience and builds trust in the platform.

7. **Virtual Card Option:**

* **What it is:** The option to receive a virtual prepaid card instead of a physical card, which can be used for online purchases.

* **How it works:** Users select the virtual card option when redeeming their reward, and the card details are delivered electronically.

* **User Benefit:** Offers a convenient and secure way to make online purchases without the need for a physical card. Virtual cards are less susceptible to loss or theft, providing an added layer of security.

## Significant Advantages, Benefits & Real-World Value of MyPrepaidCenter

MyPrepaidCenter, and the prepaid cards it manages, offers several advantages that provide real-world value to users:

* **Convenience and Flexibility:** Prepaid cards offer the convenience of a debit card without the need for a bank account. Users can spend their funds at virtually any merchant that accepts Visa or Mastercard, providing unparalleled flexibility.

* **Budgeting and Expense Control:** Prepaid cards are pre-loaded with a specific amount of money, helping users stick to their budget and avoid overspending. This is particularly useful for managing expenses or providing allowances to children.

* **Security and Fraud Protection:** Prepaid cards offer a safer alternative to carrying cash, reducing the risk of loss or theft. Additionally, Mastercard’s zero-liability protection ensures that users are not responsible for unauthorized transactions reported promptly.

* **Accessibility:** Prepaid cards are accessible to a wider range of users, including those who may not have a bank account or credit card. This makes them a valuable tool for financial inclusion.

* **Rewards and Incentives:** MyPrepaidCenter often distributes prepaid cards as rewards for participating in surveys, promotions, or loyalty programs. This provides users with a tangible incentive to engage with businesses and brands.

Users consistently report that MyPrepaidCenter simplifies the process of managing their prepaid rewards, offering a user-friendly platform and reliable customer support. Our analysis reveals that the platform’s security features and fraud protection measures provide peace of mind, while the convenience and flexibility of prepaid cards make them a valuable payment solution.

## Comprehensive & Trustworthy Review of MyPrepaidCenter

MyPrepaidCenter aims to be a user-friendly platform for managing prepaid cards received as rewards. Here’s a balanced, in-depth assessment:

### User Experience & Usability

The website has a clean and simple interface. Activating a card is generally straightforward. The process involves entering the card number, expiration date, and security code. The online account management dashboard provides a clear overview of the card balance and transaction history. However, some users have reported occasional glitches or slow loading times.

### Performance & Effectiveness

In our experience, the cards function as expected at most merchants that accept Mastercard. Online transactions are typically processed smoothly. However, some users have reported issues with using the cards at certain ATMs or for specific types of online purchases (e.g., recurring subscriptions).

### Pros:

1. **Convenient Card Management:** The online portal provides easy access to card information, transaction history, and balance inquiries.

2. **Wide Acceptance:** Mastercard prepaid cards are widely accepted at most merchants, offering flexibility in spending options.

3. **Enhanced Security:** The platform employs security measures to protect cardholders from fraud and unauthorized access.

4. **Virtual Card Option:** The option to receive a virtual card provides a convenient and secure way to make online purchases.

5. **Reward Redemption:** Simplifies the process of redeeming rewards and receiving prepaid cards.

### Cons/Limitations:

1. **Fees:** Some prepaid cards may be subject to fees, such as activation fees, monthly maintenance fees, or ATM withdrawal fees. It’s important to review the card terms and conditions carefully.

2. **Limited ATM Access:** Not all ATMs accept prepaid cards, and those that do may charge additional fees.

3. **Potential for Technical Issues:** Some users have reported occasional glitches or slow loading times on the website.

4. **Customer Service Delays:** Response times from customer service can sometimes be slow, particularly during peak periods.

### Ideal User Profile

MyPrepaidCenter is best suited for individuals who regularly receive prepaid cards as rewards or incentives and are looking for a convenient way to manage their funds. It’s also a good option for those who prefer to use prepaid cards for budgeting or expense control.

### Key Alternatives

* **Direct Deposit:** Receiving rewards or payments directly into a bank account.

* **Other Prepaid Card Providers:** Numerous other companies offer prepaid cards with varying features and fees.

### Expert Overall Verdict & Recommendation

MyPrepaidCenter is a legitimate platform that provides a valuable service for managing prepaid cards. While there are some potential drawbacks, such as fees and occasional technical issues, the benefits of convenience, security, and accessibility generally outweigh the limitations. We recommend using MyPrepaidCenter with caution, carefully reviewing the card terms and conditions, and monitoring your account for any suspicious activity. Overall, it’s a useful tool for managing prepaid rewards, but awareness is key.

## Insightful Q&A Section

Here are 10 insightful questions and expert answers regarding MyPrepaidCenter:

1. **Q: What are the most common fees associated with MyPrepaidCenter prepaid cards?**

* **A:** Common fees include activation fees, monthly maintenance fees, ATM withdrawal fees, and inactivity fees. Always review the card’s terms and conditions for a complete list of fees.

2. **Q: How do I report a lost or stolen MyPrepaidCenter prepaid card?**

* **A:** Contact MyPrepaidCenter’s customer service immediately to report the loss or theft. They will typically freeze the card and issue a replacement.

3. **Q: Can I reload my MyPrepaidCenter prepaid card?**

* **A:** It depends on the specific card. Some prepaid cards are reloadable, while others are not. Check the card’s terms and conditions to determine if reloading is an option.

4. **Q: What if a merchant refuses to accept my MyPrepaidCenter prepaid card?**

* **A:** Ensure that the merchant accepts Mastercard or Visa (depending on the card). If they do, and the card has sufficient funds, contact MyPrepaidCenter’s customer service for assistance.

5. **Q: How can I check my MyPrepaidCenter prepaid card balance?**

* **A:** You can check your balance online through your account dashboard or by calling the customer service number on the back of the card.

6. **Q: Is it safe to use my MyPrepaidCenter prepaid card for online purchases?**

* **A:** Yes, as long as you use reputable websites and follow basic online security practices. The virtual card option provides an extra layer of security for online transactions.

7. **Q: What happens to the funds on my MyPrepaidCenter prepaid card if it expires?**

* **A:** Contact MyPrepaidCenter’s customer service to inquire about the process for retrieving the remaining funds. They may issue a replacement card or provide a refund.

8. **Q: Can I use my MyPrepaidCenter prepaid card internationally?**

* **A:** It depends on the specific card and the merchant’s policies. Some prepaid cards can be used internationally, but foreign transaction fees may apply.

9. **Q: How do I dispute a transaction on my MyPrepaidCenter prepaid card?**

* **A:** Contact MyPrepaidCenter’s customer service to file a dispute. You will typically need to provide documentation to support your claim.

10. **Q: What if I forget my MyPrepaidCenter account password?**

* **A:** Use the “Forgot Password” link on the website to reset your password. You will typically need to provide your email address or phone number for verification.

## Conclusion & Strategic Call to Action

In conclusion, **MyPrepaidCenter** presents itself as a legitimate and generally reliable platform for managing prepaid cards, offering convenience and flexibility to users. However, it’s crucial to be aware of potential fees, limitations, and the importance of safeguarding your card information. By understanding the platform’s features, benefits, and potential drawbacks, you can make an informed decision about whether it’s the right choice for you. The platform offers a streamlined way to manage your prepaid rewards. Our experience suggests that users who are diligent about reading the terms and conditions and monitoring their accounts are most likely to have a positive experience.

Now that you have a comprehensive understanding of MyPrepaidCenter, share your own experiences with the platform in the comments below. Your insights can help others make informed decisions. Explore our advanced guide to prepaid card security for more tips on protecting your financial information. Contact our experts for a consultation on optimizing your prepaid card usage.